October '23 Market Report

Buyers continue to face depleted and picked-over inventory. Post-pandemic inventory levels have dramatically dropped since 2019. The inventory levels on October 1st are down by 28% compared to last year and by 60% compared to 2019.

Due to the rapid sale of prime new listings, the remaining available listings on the market are typically overpriced or lack the desired condition and detailing sought by buyers.

Despite the inventory shortages, the number of showings in September decreased merely by 4% compared to last year and by 10% compared to 2019.

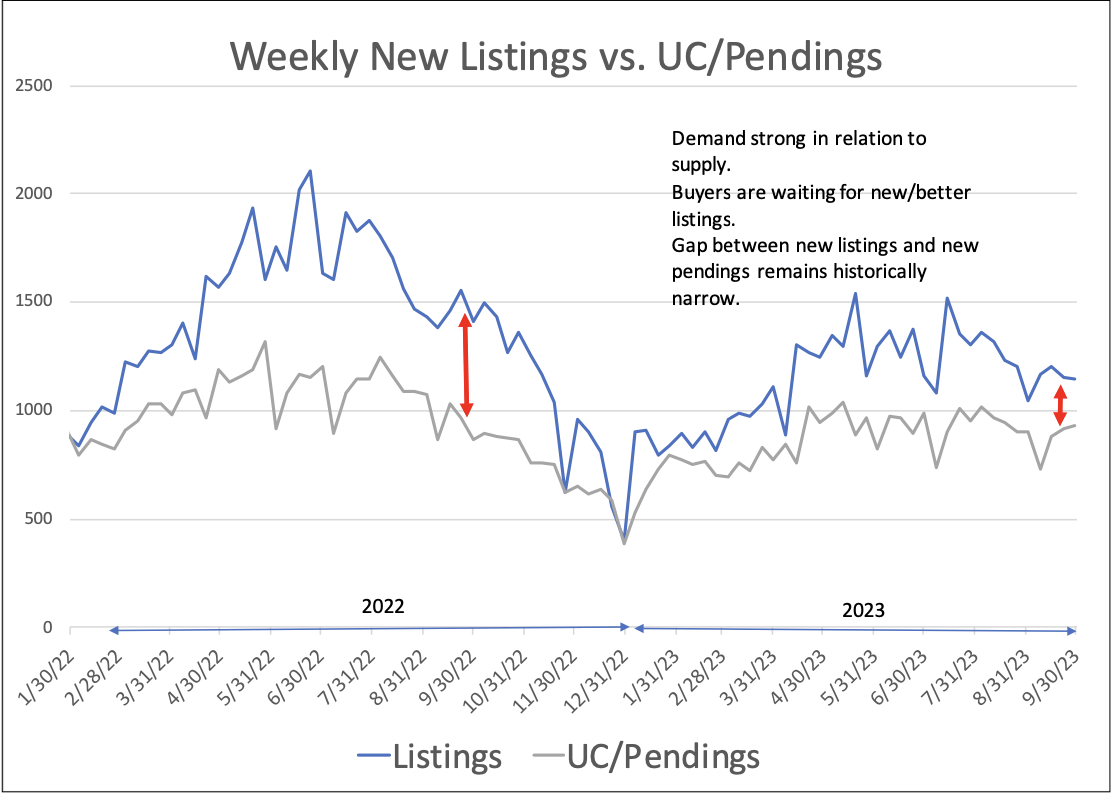

The chart below illustrates the weekly influx of new listings in comparison

to pending sales. Observe the narrow gap between new listings and new pendings in 2023 as opposed to 2022. Additionally, note how closely the trend of new pending sales follows that of new listings. As the number of new listings surges, pendings swiftly follow suit. Amid this year’s inventory shortages, buyers continue to await the arrival of new listings. As soon as quality listings arrive, buyers are quick to secure them.

A large pool of buyers has been actively looking, yet unsuccessful in their bids for a new home. The best new listings continue to sell swiftly, often with multiple offers and prices exceeding the asking amount. Over half of the new pending sales in September were under contract within 10 days or less.

The average Days on Market (DOM) for new pendings in September stood at 30 days, while the DOM for current active listings, which have yet to accept an offer, is 90 days.

Sixty-two percent of the closed sales in September were finalized at prices at or above the full asking price. To elaborate, 45% closed above the full asking price, 17% were at the asking price, and 38% sold for less.

Prices tend to soften in the second half of the year as both the quality and quantity of inventory decline.

Comparatively, prices were slightly lower through June when juxtaposed with the previous year, but have exhibited an uptick in the recent months. September’s average price of $189 per square foot was a 5% increment compared to last year.

By the year’s end, it is anticipated that the annual price per square foot for 2023 will exhibit a 2% increase compared to 2022.