June '23 Market Report

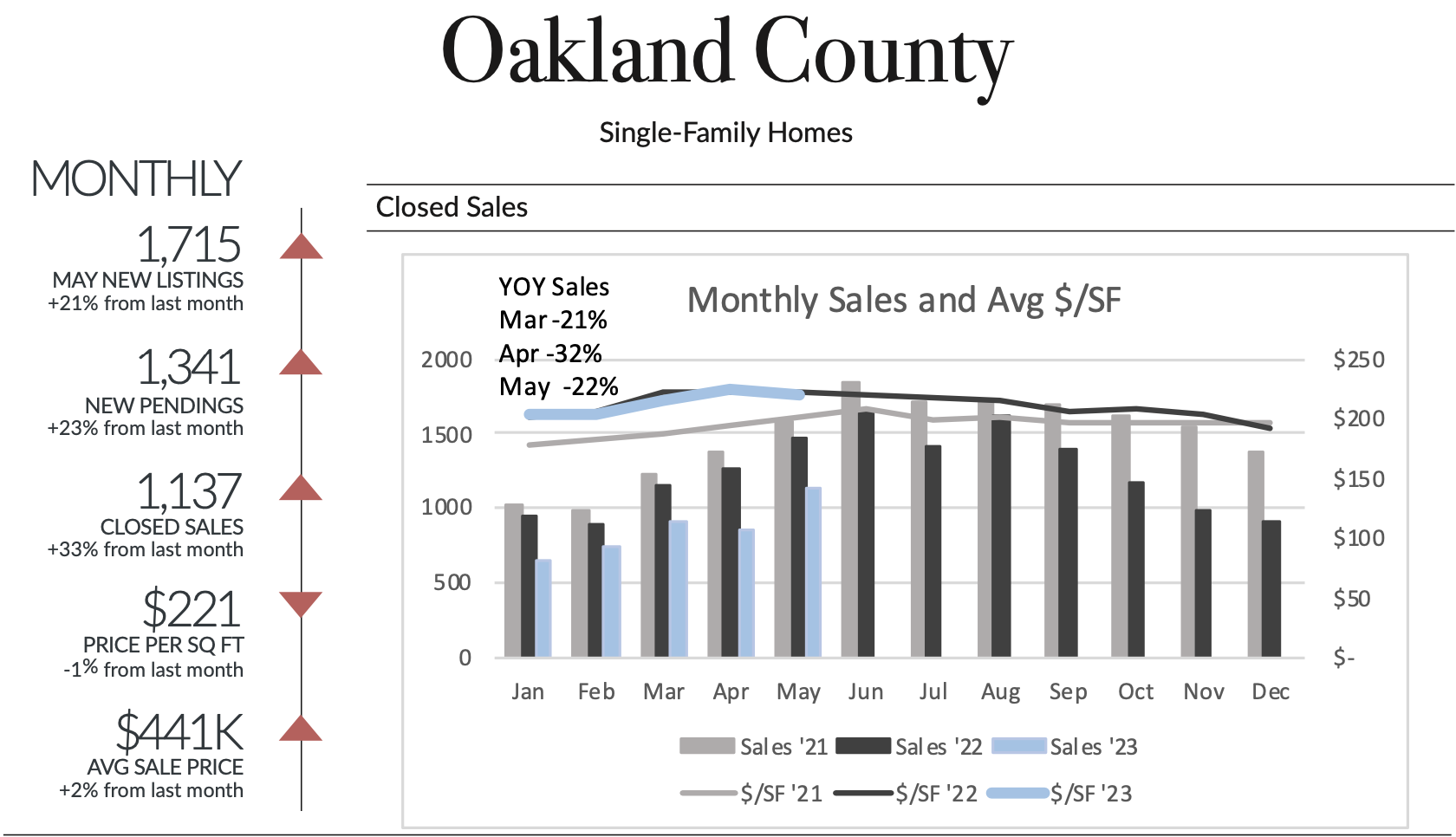

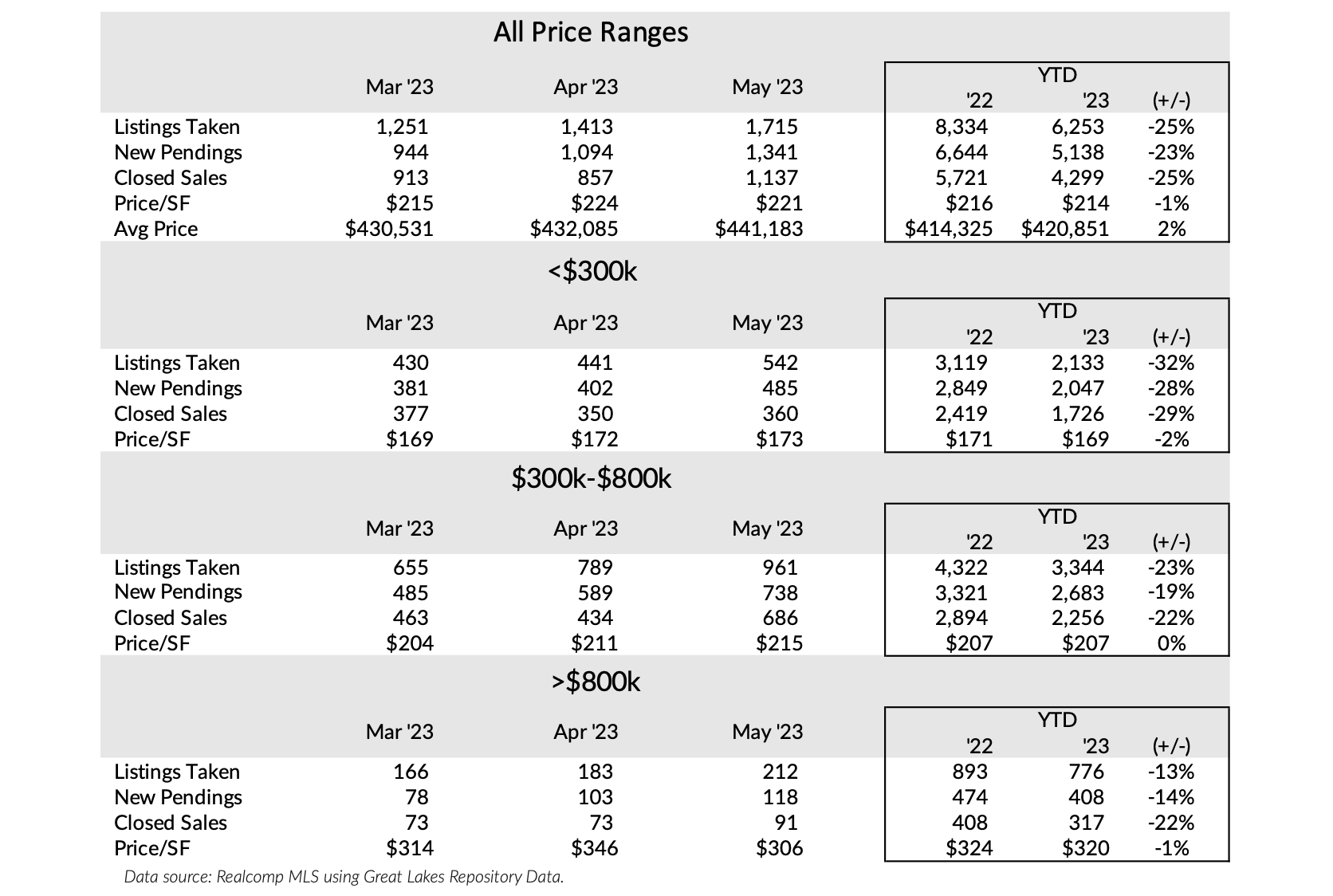

This year’s 20% YTD decline in sales is directly linked to the scarcity of new listings—down 21% YTD and slightly more in recent months. Buyers continue to wait for move-in-ready listings, especially in the more affordable price ranges. In May, we saw 24% fewer homes listed compared to the same time last year, a decrease of 1,741 homes. Current demand consistently exceeds available supply.

Buyer demand remains stable and high. Southeast Michigan YTD sales and average price are down 20% and 2% respectively, but both are the result of depleted inventory levels—quantity and quality. Premium listings sell for higher prices, when inventory levels are lower and picked over, average prices decline. When seen in the full context of the inventory situation, the 2% decline in YTD average sale price indicates that our historic high values are stable and holding.

Over half of the sales in May closed above the full asking price, while another 15% matched it. Although the May percentage of over-asking sales was slightly lower than the intense mid- pandemic numbers in 2022 and 2021, they are nearly double the pre-pandemic percentages. Moving forward, sustained strong demand will ensure stable prices.